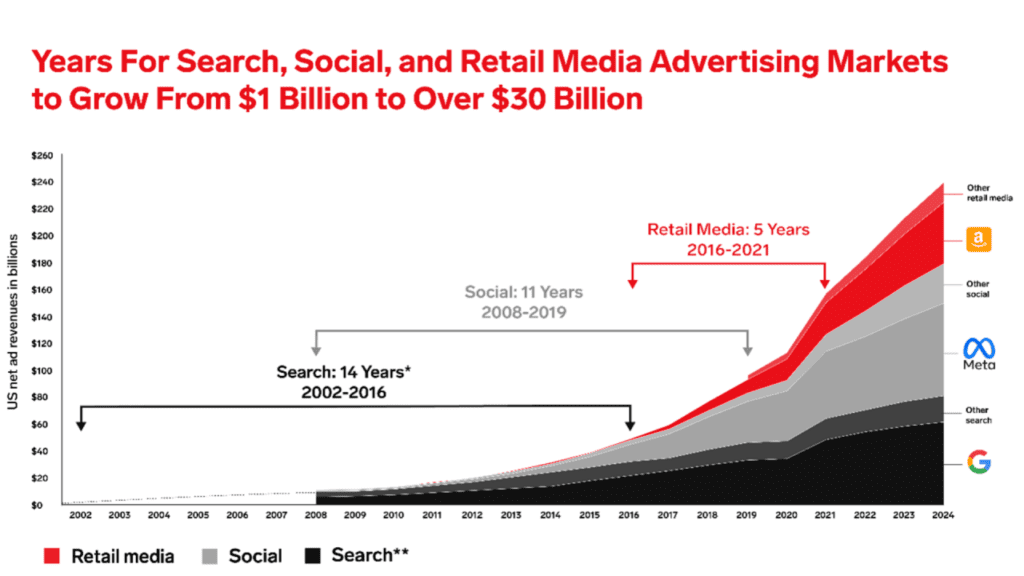

The Future of Retail Media is poised for explosive growth, with projections surpassing $2.8 billion in Australia by 2027. This trajectory outpaces traditional channels like search and social, and it’s expected to rival television advertising in the near future. This surge is fueled by factors such as cookie deprecation and retail media’s superior targeting, closed-loop measurement, brand safety, and proximity to the point of sale.

But beyond these established drivers, what emerging trends will shape the future of retail media investment? Here’s a look at what’s on the horizon:

Blurring the Lines Between Commerce and Social Media: Social platforms like TikTok are expanding into product fulfillment, while Amazon integrates social features. This convergence promises a seamless shopping experience across platforms, possibly extending into traditional television.

Dynamic Formats: The Era of Engagement: Static banners are giving way to shoppable videos, immersive experiences, and in-store media connected to digital channels. These interactive formats will capture attention and enhance customer interaction.

Beyond the Bottom Funnel: Retail media investment currently emphasizes lower-funnel activities (product, price, promotion). As the market matures, expect data-driven investment in upper-funnel activities like brand awareness and audience building.

Performance and Brand in Harmony: Platforms are catering to both sales conversion and brand-building goals. This offers a holistic approach, fostering brand loyalty while driving bottom-line results.

The Rise of Non-Endemic Brands: While endemic brands (those who sell on the platform) still dominate, non-endemics are recognizing the value of targeting consumers at the point of purchase. This broadens reach and enables hyper-targeted advertising.

From Broad to Niche: While giants like Coles, Woolworths, and Amazon focus on point-of-purchase impact, new entrants are specializing to capture investment. Uber markets to captive audiences during wait times, loyalty card wallets incentivize store visits, and other networks focus on generating reviews and cashback offers.

Unlocking Brand-Owned Assets: Physical stores possess valuable media inventory – in-store screens and displays. Utilizing these assets for retail media not only drives sales and loyalty but generates revenue to further develop in-store media solutions. [Include a statistic on the estimated value of brand-owned assets for added impact].

Technology as the Growth Engine: Innovative platforms simplify the retail media landscape. These platforms enable multi-retailer campaigns, provide cross-channel insights, and streamline the ad-buying process, empowering brands to navigate this complex space.

Agencies: Essential Navigators: Agencies offer invaluable expertise in retail media strategy, execution, and measurement. Their guidance is crucial as brands capitalize on this dynamic channel.

Platform-Supported Joint Business Plans: Streamlining collaboration, these platforms allow brands and partners to import JBPs for transparency and efficient tracking of spend, remaining budget, and the partnership’s added value.

AI Personalization: Retail media leverages AI and machine learning for optimized ad targeting, dynamic creative, and maximum campaign impact.

Holistic Measurement for Success: Understanding the interplay between retail media and other channels (search, social, TV) is key to optimal marketing spend. A holistic approach yields data-driven insights for future campaigns.

The Outlook

Retail media’s future is bright. By embracing these trends, harnessing technology, and partnering strategically, brands can harness this dynamic channel to achieve their marketing goals in the ever-evolving retail landscape.